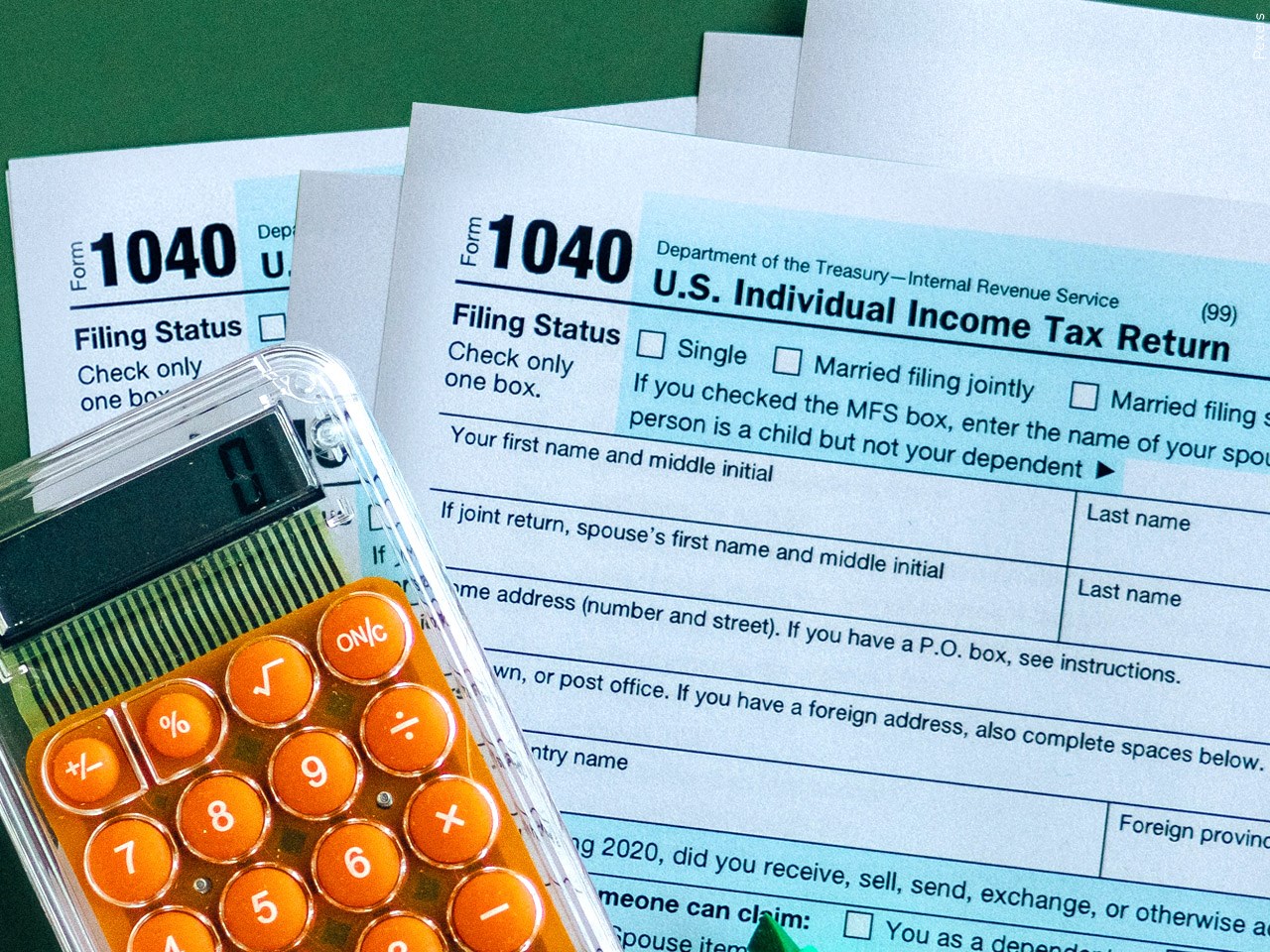

mississippi income tax payment

How do you calculate state taxes in Mississippi. You can use this service to quickly and securely pay your Mississippi taxes using a credit card debit.

Where S My Refund Mississippi H R Block

0421 Mississippi Corporate Income Tax Voucher Instructions Estimated Tax Payments Every corporate taxpayer having an annual income tax liability in.

. Individual Income Corporate and Pass-Through-Entities may access account. Mississippi Installment Agreement for Businesses. Over 40 different tax account types can use TAP to access account information file and pay returns.

Emergency Services Health Social Services New Residents Guide E11 Directory. Your payment schedule ultimately will depend on the average amount you hold from employee. Under the Mississippi Tax Freedom Act of 2022 the first 10000 of a taxpayers income will not be taxed but any additional income will be taxed at a rate of 5 in 2023.

Make a Tax Payment. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return. Tin tax payer identification number.

Mississippi State Income Tax Forms for Tax Year 2021 Jan. Mississippis income tax ranges between 3 and 5. Pass Through Entity Forms Mailing Address Information Combined Filers - Filing and Payment Procedures Hurricane Katrina Information.

Unlike the Federal Income Tax Mississippis state income tax does not provide. Welcome to the online Mississippi Tax QuickPay for Businesses and Individuals. All other income tax returns P.

Corporate Income and Franchise Tax Forms. Mississippi collects a state income tax at a maximum marginal tax rate of spread across tax brackets. If you make 70000 a year living in the region of mississippi usa you will be taxed 11472.

Taxpayer Access Point TAP Online access to your tax account is available through TAP. Taxpayers that reside have a business or whose records are located in Hinds County have until February 15 2023 to file individual income tax returns corporate income and franchise tax. If you move after filing your Mississippi income tax return you will need to notify the Department of Revenue of your new address by letter to.

Box 23050 Jackson MS 39225-3050. This form is for income earned in tax year 2021 with tax returns due in April 2022. Because the income threshold for the top bracket is quite.

The state uses a simple formula to determine how much someone owes. We last updated Mississippi Form 80-106 in January 2022 from the Mississippi Department of Revenue. For business tax liabilities the Mississippi DOR will generally require the business put down at 33 with a duration to pay it off around 6.

Mississippi Income Tax Forms. In Mississippi there are two payment schedules for withholding taxes. Ms Income Tax Payment.

A downloadable PDF list of all available. Individual Income Tax Division PO. The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5.

0621 Mississippi Individual Fiduciary Income Tax Voucher Instructions Who Must Make Estimated Tax Payments Every individual taxpayer who does not. There was the thought eliminating the income tax could drive other costs up and it could hurt the state budget and households the business councils report said.

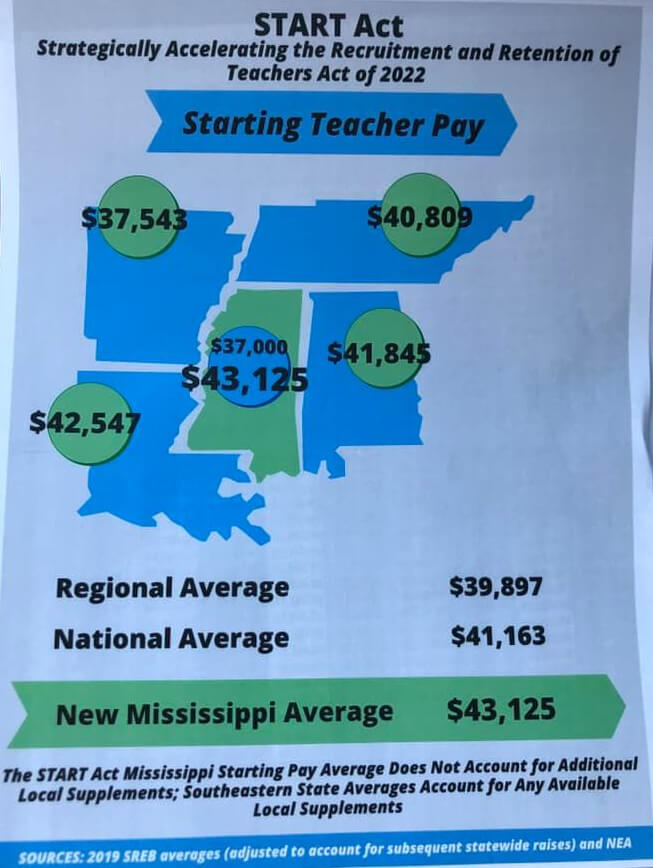

Update Tax Cuts Pay Hikes Highlight House Action Desoto County News

Mississippi New Laws Tax Cut Teacher Pay Raise State Song Breezynews Com Kosciusko News 24 7

Mississippi Senate Reviewing Bill To End State Income Tax

How To Form An Llc In Mississippi Llc Filing Ms Swyft Filings

Mississippi House Of Representatives Votes To Eliminate Income Tax Supertalk Mississippi

Mississippi Paycheck Calculator Smartasset

Solved Wisconsin Credit For Taxes Paid To Another State

Ganucheau The Mississippi Republican Income Tax Bet The Sun Sentinel

Ms Tax Freedom Act Of 2022 Mageenews Com

/cloudfront-us-east-1.images.arcpublishing.com/gray/ZGQL7TXAKZESPG35EFTKAHTZWQ.jpg)

Education Advocates Critical Of House Income Tax Bill

Mississippi Tax Rates Rankings Ms State Taxes Tax Foundation

Mississippi Tax Commission To Make Change For Correct Sales Tax Payment 2 Coins Ebay

Mississippi State Income Tax To Reduce Over The Next Four Years

Form 80 106 Individual Fiduciary Income Tax Voucher

Mississippi Senate To Drop Tax Reduction Plan To Eliminate 4 Income Tax Bracket Mississippi Politics And News Y All Politics

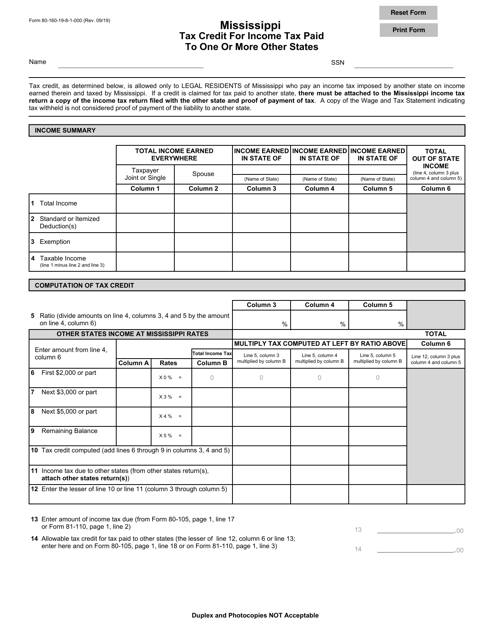

Form 80 160 19 8 1 000 Download Fillable Pdf Or Fill Online Mississippi Tax Credit For Income Tax Paid To One Or More Other States Mississippi Templateroller

Strengthening Mississippi S Income Tax Hope Policy Institute

Mississippi Llc Tax Structure Classification Of Llc Taxes To Be Paid